CRISIL, ICRA rally ahead of CARE public issue (IPO)

Hiranandani Business Park

Shares of listed rating agencies Crisil and ICRA surged on Monday on the bourses ahead of Credit Analysis and Research’s initial public offering.

The objects of the issue are to:

CRISIL House - the 2,11,610 sq.ft

Corporate Head Office

Central Avenue

Powai, Mumbai

Shares of listed rating agencies Crisil and ICRA surged on Monday on the bourses ahead of Credit Analysis and Research’s initial public offering.

ICRA touched a record high on Monday at Rs 1,582.10. The stock closed at Rs 1,576, up 19.53 per cent on the Bombay Stock Exchange.

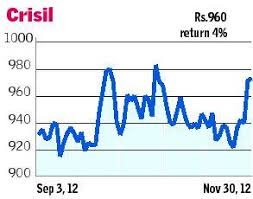

The other listed ratings agency Crisil also surged on the bourses to close at Rs 1,060.75, up 10.39 per cent from its previous close on the BSE. Intra-day, the stock zoomed to Rs 1,099.90. Both counters attracted heavy trading interest, and volumes were several times higher than usual.

According to analysts, Crisil and ICRA have rallied as CARE is coming out with a public issue at a stiff valuation. However, once the issue is over, these stocks may correct, they say.

The CARE IPO, which opens on December 7 and closes on December 11, will be the third rating agency to be listed on the bourses. “To some extent, the CARE IPO has been over priced. Long-term investors who accumulate the stock post listing will benefit,” said Dharmesh Pancholi, Senior Manager, Advisory (Equity), Sharekhan.

Analysts said the increasing number of opportunities in this sector is exciting investors. Nowadays, a mere downgrade can have an impact on the markets.

“The importance of ratings has gone up in recent times. Not only is there respect for ratings but also a demand for it. The increase in the number of bond and debt issuances is positive for the ratings industry,” said Shrikant Shetty, an independent analyst.

The ICRA stock has constantly been gaining over the last month. It was Rs 1,359.70 in the month-ago period. The scrip of Crisil has also seen an increase from Rs 940 in the month-ago period.

Care IPO price band set at Rs 700-750

Incorporated in 1993, Credit Analysis & Research Ltd (CARE) is the second largest full-service credit rating company in India. CARE offers rating and grading services across a diverse range of instruments and industries including IPO grading, equity grading, and grading of various types of enterprises, including shipyards, maritime training institutes, construction companies and rating of real estate projects, among others. They also provide general and customized industry research reports.

CARE's existing shareholders include domestic banks and financial institutions, such as IDBI Bank, Canara Bank, SBI and IL&FS etc. Company's list of clients includes banks and other financial institutions, private sector companies, central public sector undertakings, sub-sovereign entities, small and medium enterprises and micro-finance institutions.

They are the leading credit rating agency in India for IPO grading having graded the largest number of IPOs since the introduction of IPO grading in India. CARE Ratings has completed over 19069 rating assignments having aggregate value of about Rs. 44051 bn (as of September 30, 2012), since its inception in April 1993.

Company Financials:

| Particulars | For the year/period ended (in Rs. Million) | ||||

| 31-Dec-12 | 31-Mar-11 | 31-Mar-10 | 31-Mar-09 | 31-Mar-08 | |

| Total Income | 2,171.93 | 1,722.55 | 1,520.26 | 999.31 | 549.11 |

| Profit After Tax (PAT) | 1,157.02 | 879.49 | 856.90 | 523.99 | 266.85 |

Objects of the Issue:

1. Carry out sale of 7,199,700 Equity Shares by the Selling Shareholders; and

2. To achieve the benefits of lisitng the Equity Shares on the Stock Exchanges.

2. To achieve the benefits of lisitng the Equity Shares on the Stock Exchanges.

Issue Detail:

»» Issue Open: Dec 07, 2012 - Dec 11, 2012

»» Issue Type: 100% Book Built Issue IPO

»» Issue Size: 7,199,700 Equity Shares of Rs. 10

»» Issue Size: Rs. 503.98 - 539.98 Crore

»» Face Value: Rs. 10 Per Equity Share

»» Issue Price: Rs. 700 - Rs. 750 Per Equity Share

»» Market Lot: 20 Shares

»» Minimum Order Quantity: 20 Shares

»» Listing At: BSE, NSE

»» Issue Type: 100% Book Built Issue IPO

»» Issue Size: 7,199,700 Equity Shares of Rs. 10

»» Issue Size: Rs. 503.98 - 539.98 Crore

»» Face Value: Rs. 10 Per Equity Share

»» Issue Price: Rs. 700 - Rs. 750 Per Equity Share

»» Market Lot: 20 Shares

»» Minimum Order Quantity: 20 Shares

»» Listing At: BSE, NSE

(Credit Analysis & Research Ltd) CARE IPO Grading

CARE, being a credit rating company in India, is exempted by SEBI from obtaining the IPO grading for its Initial Public Offer. None of the rating companies including CRISIL, FITCH or ICRA graded CARE IPO.

Source : Pic: http://bhavikkshah.blogspot.in, http://www.thehindubusinessline.com, http://bse2nse.com ,http://www.chittorgarh.com

No comments:

Post a Comment