A Brimming Cup Of Woes

There’s no easy end in sight for the Jignesh Shah-promoted FTIL and MCX

TREND

There’s no easy end in sight for the Jignesh Shah-promoted FTIL and MCX

For most of us, having Rs 3,000 crore in personal wealth is unimaginable, let alone the idea of losing that amount in less than a year. Jignesh Shah lost just that, but no one is feeling sorry for him. The aggressive and ambitious founder-promoter of Financial Technologies India (FTIL) is grappling with the fallout of a crisis that has engulfed one of the country’s biggest spot commodity exchanges, the National Spot Exchange (NSEL).

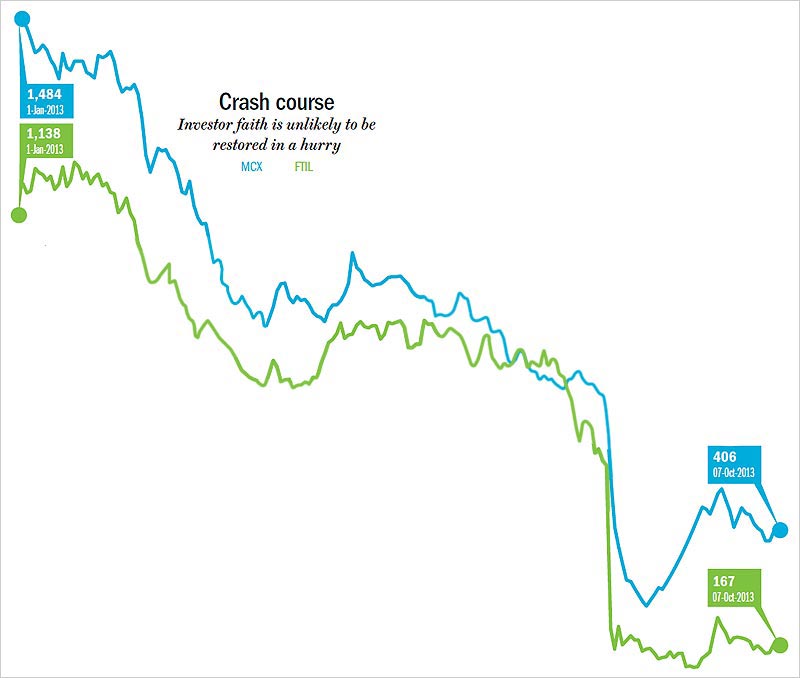

The debacle began when NSEL — a company promoted by FTIL — suspended trading of its short-term contracts and decided to club the entire outstanding and settle them together. The Rs 5,600-crore payment crisis that has since gripped the exchange has had a cascading effect on the fortunes of the listed promoter entity, FTIL, and also of MCX, the other listed commodity exchange. The stock prices have crashed by 85% and 72%, respectively, since January 1, 2013 to Rs 167 and Rs 406. Shah owns 45% and 26%, respectively, in both the entities.

Incidentally, MCX also holds minority stake in a few exchanges, promoted by FTIL, such as MCX-SX (5% equity interest, 33% economic interest through warrants) and 5% equity stake in Dubai Gold and Commodities Exchange. While MCX-SX is the number two currency derivatives exchange in India, after NSE, its equity exchange operations is a distant third, after NSE and BSE.

The irony escapes no one, considering both the stocks were counted among the Street’s favourites. In fact, just before the crisis broke out, Kotak Institutional Equities had, in May, initiated coverage on the MCX stock with a fair value of Rs 990 a share, citing the exchange’s growing heft in the commodities business. Similarly, early this year, Karvy Stock Broking had put out a target of Rs 1,446 for FTIL for its comprehensive role in the financial markets. Madhumita Ghosh, senior vice-president, research, Unicon Securities, says, “The damage is of a varied kind. The brand name has already gone for a toss for MCX and I don’t see any positive development in the stock, in the near future.”

There is also the risk of FTIL losing control over both the exchanges in the event the Forward Markets Commission deems it fit to remove the management and Sebi takes similar action with respect to MCX-SX, which falls under its regulatory purview. However, some see a positive rub-off in case of a management change. Harendra Kumar, MD, institutional equities, Elara Capital, says, “Though the process will take some time, once that [ownership change] happens, MCX might bounce back.” But as things stand today, the future is far from bright for FTIL and MCX.

Source : http://business.outlookindia.com, Sneha Shankar

----------------------------------------------------------------------------------------------------------------------------------

NSEL settlement hopes propel FT stock

Shares double from August lows on talks of settlement plan backed by Shah's own holding, stake sale in NK Proteins

Jignesh Shah

Financial Technologies (India) Ltd (FTIL), promoter of the crisis-ridden National Spot Exchange Ltd (NSEL), has gained around 115 per cent since August 30 amid expectations that the group could get some relief from the speculated sale of NK Proteins, a borrower company.

The stock, which had touched a low of Rs 102 amid the Rs 5,600-crore payment crisis at NSEL, closed at Rs 217.40, up 18.25 per cent over its previous close, on the BSE on Thursday. While the reversal in broader market trend has helped the rise, brokers attribute the spike in the last two-three sessions to the deal talks.

There is talk of negotiations between Jignesh Shah, promoter of FTIL and NSEL, and investors in the exchange. “There are negotiations with Shah on a daily basis. Top brokers and investors are trying to convince Shah to put in part of his promoter holding in FT in an escrow account as a guarantee and then go about the recovery. That will boost the confidence of investors,” said a large investor of NSEL, who was part of the negotiations.

A senior official with a large brokerage, which has exposure to NSEL, also said a securitisation plan that involves Shah’s personal stakes in FTIL is being chalked out to settle dues to investors.

A committee appointed by the finance ministry was also expected to submit its reports on the crisis by September 12. There are other deal talks, too.

“That trade is because of rumours that one of the troubled borrowers will be sold off and the proceeds will give some cushion to the group,” said Arun Kejriwal of Kejriwal Research and Investment Services. “That will also help secure part of the bridge loan by FT given to NSEL.”

The stock, which had touched a low of Rs 102 amid the Rs 5,600-crore payment crisis at NSEL, closed at Rs 217.40, up 18.25 per cent over its previous close, on the BSE on Thursday. While the reversal in broader market trend has helped the rise, brokers attribute the spike in the last two-three sessions to the deal talks.

There is talk of negotiations between Jignesh Shah, promoter of FTIL and NSEL, and investors in the exchange. “There are negotiations with Shah on a daily basis. Top brokers and investors are trying to convince Shah to put in part of his promoter holding in FT in an escrow account as a guarantee and then go about the recovery. That will boost the confidence of investors,” said a large investor of NSEL, who was part of the negotiations.

A senior official with a large brokerage, which has exposure to NSEL, also said a securitisation plan that involves Shah’s personal stakes in FTIL is being chalked out to settle dues to investors.

A committee appointed by the finance ministry was also expected to submit its reports on the crisis by September 12. There are other deal talks, too.

“That trade is because of rumours that one of the troubled borrowers will be sold off and the proceeds will give some cushion to the group,” said Arun Kejriwal of Kejriwal Research and Investment Services. “That will also help secure part of the bridge loan by FT given to NSEL.”

Market circles and social media were abuzz with the deal and even proposed valuations. Deena Mehta, senior broker and managing director of Asit C Mehta, tweeted: “Cargill India may acquire 57 per cent stake in NK Proteins, valuation of NK at 1,150 crore relief for NSEL investors?”

However, some dismissed these speculations as a two-year old news and Minneapolis-based firm may not be interested in the Ahmedabad-based cooking oil maker given its contingent liabilities of over Rs 929 crore to NSEL.

In March 2011, Mint had reported Cargill India was in advanced talks with NK Protein for a 57 per cent stake sale. NK Proteins is one of the portfolio companies of Brand Capital, the investment arm of Bennett, Coleman Co, the leading publishing house in the country.

Kejriwal also pointed out speculators are running amok in the stock though it is in the futures and options ban list due to heavy positions. “Though in the ban list, brokers are allowed to trade by paying a fine of Rs 1 lakh. That is also driving speculative positions,” he said.

Though the stock has run up by 115 per cent from its lows in the last 10 days, that amounts to a recovery of 14 per cent for large institutions such as Blackstone who had entered the stock at Rs 810 levels. For those who entered at peak prices of over Rs 1,223, that is an even smaller consolation.

However, some dismissed these speculations as a two-year old news and Minneapolis-based firm may not be interested in the Ahmedabad-based cooking oil maker given its contingent liabilities of over Rs 929 crore to NSEL.

In March 2011, Mint had reported Cargill India was in advanced talks with NK Protein for a 57 per cent stake sale. NK Proteins is one of the portfolio companies of Brand Capital, the investment arm of Bennett, Coleman Co, the leading publishing house in the country.

Kejriwal also pointed out speculators are running amok in the stock though it is in the futures and options ban list due to heavy positions. “Though in the ban list, brokers are allowed to trade by paying a fine of Rs 1 lakh. That is also driving speculative positions,” he said.

Though the stock has run up by 115 per cent from its lows in the last 10 days, that amounts to a recovery of 14 per cent for large institutions such as Blackstone who had entered the stock at Rs 810 levels. For those who entered at peak prices of over Rs 1,223, that is an even smaller consolation.

Source : http://www.business-standard.com

------------------------------------------------------------------------------------------------------------

FTIL, MCX shares spurt on Shah stake sale rumour

L&T Infotech, Infosys, Cognizant, RIL and Thomson Reuters, were named as being interested in buying the stake

The shares of Financial Technologies (India) Limited and Multi Commodity Exchange of India rose on Wednesday following rumours of a promoter stake-sale.

FTIL rose 3.2 per cent and MCX by four per cent. L&T Infotech, Infosys and Cognizant, in addition to Reliance Industries and Thomson Reuters, were the names which did the rounds as being interested in buying the stake of Jignesh Shah, the promoter of FTIL. The company later denied the news.

Earlier, according to sources, Tech Mahindra had shown interest in buying a part of Shah’s stake in FTIL. However, these talks did not result in a deal, leading the company to seek fresh partners for a stake sale. Shah currently has 45.63 per cent stake in FTIL and is looking at offloading 26 per cent, say sources.

FTIL recently said it had appointed a financial advisor on divesting stake in MCX. The former was declared not ‘fit and proper’ by the Forwards Market Commission, the commodity regulator, to be anchor investor in any exchange, after the Rs 5,600 crore National Spot Exchange (NSEL) scam broke out. FTIL owns the spot exchange.

JM Financial had been asked to search for a strategic partner for the MCX stake sale. FTIL is looking at divesting 24 per cent in the commodity exchange. JM Financial has also been asked to oversee a restructuring plan of the company.

The turnover of FTIL shares in on the BSE was Rs 156 crore; of MCX, Rs 160 crore. Meanwhile, Jignesh Shah said MCX and FTIL had reached an agreement for transfer of technology for an annual payment of Rs 70 crore.

FTIL rose 3.2 per cent and MCX by four per cent. L&T Infotech, Infosys and Cognizant, in addition to Reliance Industries and Thomson Reuters, were the names which did the rounds as being interested in buying the stake of Jignesh Shah, the promoter of FTIL. The company later denied the news.

Earlier, according to sources, Tech Mahindra had shown interest in buying a part of Shah’s stake in FTIL. However, these talks did not result in a deal, leading the company to seek fresh partners for a stake sale. Shah currently has 45.63 per cent stake in FTIL and is looking at offloading 26 per cent, say sources.

FTIL recently said it had appointed a financial advisor on divesting stake in MCX. The former was declared not ‘fit and proper’ by the Forwards Market Commission, the commodity regulator, to be anchor investor in any exchange, after the Rs 5,600 crore National Spot Exchange (NSEL) scam broke out. FTIL owns the spot exchange.

JM Financial had been asked to search for a strategic partner for the MCX stake sale. FTIL is looking at divesting 24 per cent in the commodity exchange. JM Financial has also been asked to oversee a restructuring plan of the company.

The turnover of FTIL shares in on the BSE was Rs 156 crore; of MCX, Rs 160 crore. Meanwhile, Jignesh Shah said MCX and FTIL had reached an agreement for transfer of technology for an annual payment of Rs 70 crore.

Financial Technology's Shareholding Pattern

Multi Commodity Exchange's Shareholding Pattern

Source : http://www.business-standard.com, http://profit.ndtv.com,

No comments:

Post a Comment