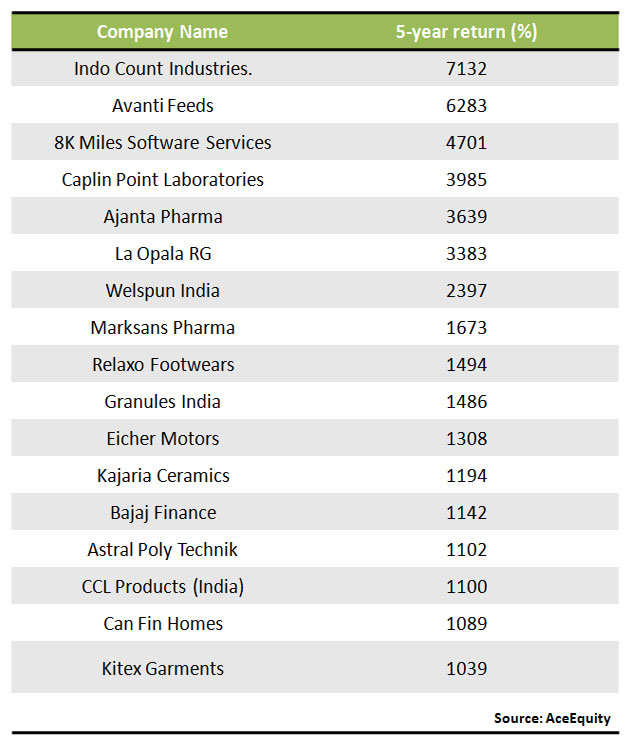

Rs 1 lakh invested in these stocks could have earned you up to Rs 72 lakh in 5 years

It's not easy to strike gold in stocks. But it's quite common to miss out on opportunities.Multibagger stocks are a rare breed on Dalal Street, but they remind you of the power that equities wield.

"There is a higher possibility that a steady investor would receive positive payoffs over time. If history is any indicator, the possibility of negative returns on stocks is almost zero with a 15-year investment horizon," Nilesh Shah, MD, Kotak Mahindra Asset Management, said in a column written exclusively for ETMarklets.com.

At ETMarkets.com, we embarked on a similar search to find the biggest multibagger stories of the last five years and came out with these hidden gems.

And the list might leave you wondering how come you missed these stocks, worse still, if you happened to sell any of them just because they wobbled a bit along their journey.

And the list might leave you wondering how come you missed these stocks, worse still, if you happened to sell any of them just because they wobbled a bit along their journey. Five years ago, had you to invested Rs 1 lakh on Indo Count, it would have made you Rs 72 lakh today. Avanti Feeds could have generated about Rs 62 lakh on that investment and 8K Miles Software Rs 47 lakh.

These are very real wealth creation stories, and not just talk without substance.

Indo Count reported a 15 per cent volume growth in the March quarter of FY16, which helped its revenue grow 15 per cent. Brokerage firm Systematix expects it to post 29 per cent annualised profit growth in FY16-18 and has a buy rating with target price of Rs 1,373.

Sandeep Raina, Deputy Vice President, Edelweiss, believes Indo Count can still be a multibagger despite the huge returns it has generated so far. "The growth is there, the Market is there. Financials are very strong. I think the company can be a multibagger over the next two-three years," he said.

8K Miles Software, a multibagger with 4,700 per cent returns over five years, reported 109 per cent profit growth in March quarter as the company built on its recent strong performances.

"8K Miles has got a solid product pipeline. So there is merit in looking at the stock on a fundamental basis. But the valuations have already reached a level from where incremental appreciation will be difficult," Sudip Bandyopadhyay, an independent market expert, told ET Now.

These are among the least talked about names on the Street, a place where the TCSs, Infosys and RILs of the world hog the limelight while smaller stocks like these silently churn out big returns for their investors.

Source : http://economictimes.indiatimes.com; Chiranjivi Chakraborty

No comments:

Post a Comment